Travis Perkins Group is the UK's largest distributor of building materials. |

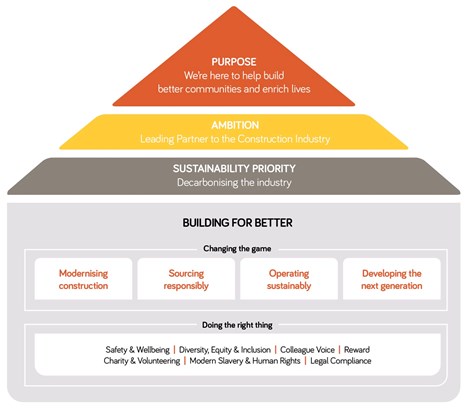

The Group has set out its ambition to become the leading partner to the construction industry. The investment case set out below provides an overview of the Group, explores the long term structural drivers of the end markets that the Group serves and explains the sources of competitive advantage that will enable the Group to achieve this ambition and deliver attractive returns for shareholders. |

The Group is guided by a clear purpose |

|

Operating and leading in attractive markets |

The Group benefits from diverse end market exposure across the construction sector. |

|

Proud to have helped to build Britain for over 200 years, Travis Perkins plc is the largest distributor of building materials in the UK. The Group employs c.17,000 colleagues across a portfolio of market leading businesses, which are all #1 or #2 in their markets. |

|

Travis Perkins plc - a leading partner to the construction industry with a clear strategy for growth |

|

Long term structural growth drivers |

|

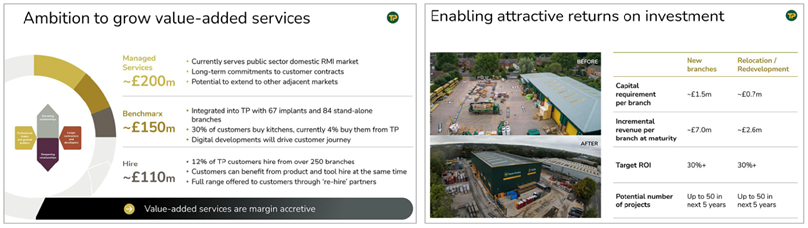

Merchanting market share gains driven by network expansion and value-added services |

|

|

Substantial Toolstation growth potential in both UK and European markets |

|

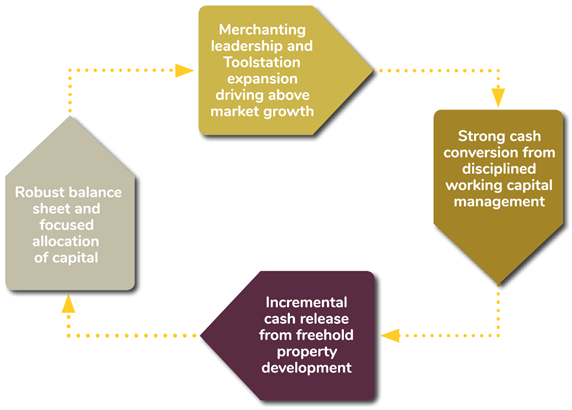

Maintaining operational agility and discipline in capital allocation |

|  |

|  |

Since 2010 the market value of the Group’s freehold estate has grown by almost £600m and the book value has grown by c.£240m. During this period the portfolio has also generated net proceeds after reinvestment of £100m and profits of £300m. This property portfolio management strategy enables the Group to access the best operational sites, generate cash and release profits. |

Attractive returns for shareholders |

|

|